are union dues tax deductible in california

Bitcoin se encuentra en la red y en el mercado en la nave del futuro en el mercado virtual y en los bancos internacionales. The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for.

5 Ways California Tax Filers Leave Money On The Table Kpcc Npr News For Southern California 89 3 Fm

Current state law already allows taxpayers to deduct their union dues paid as a miscellaneous itemized.

. Best places to buy bitcoin with debit card for best rates. For tax years 2018 through 2025 union dues and all employee. Most unions and associations send their members a statement of the fees or subscriptions they pay.

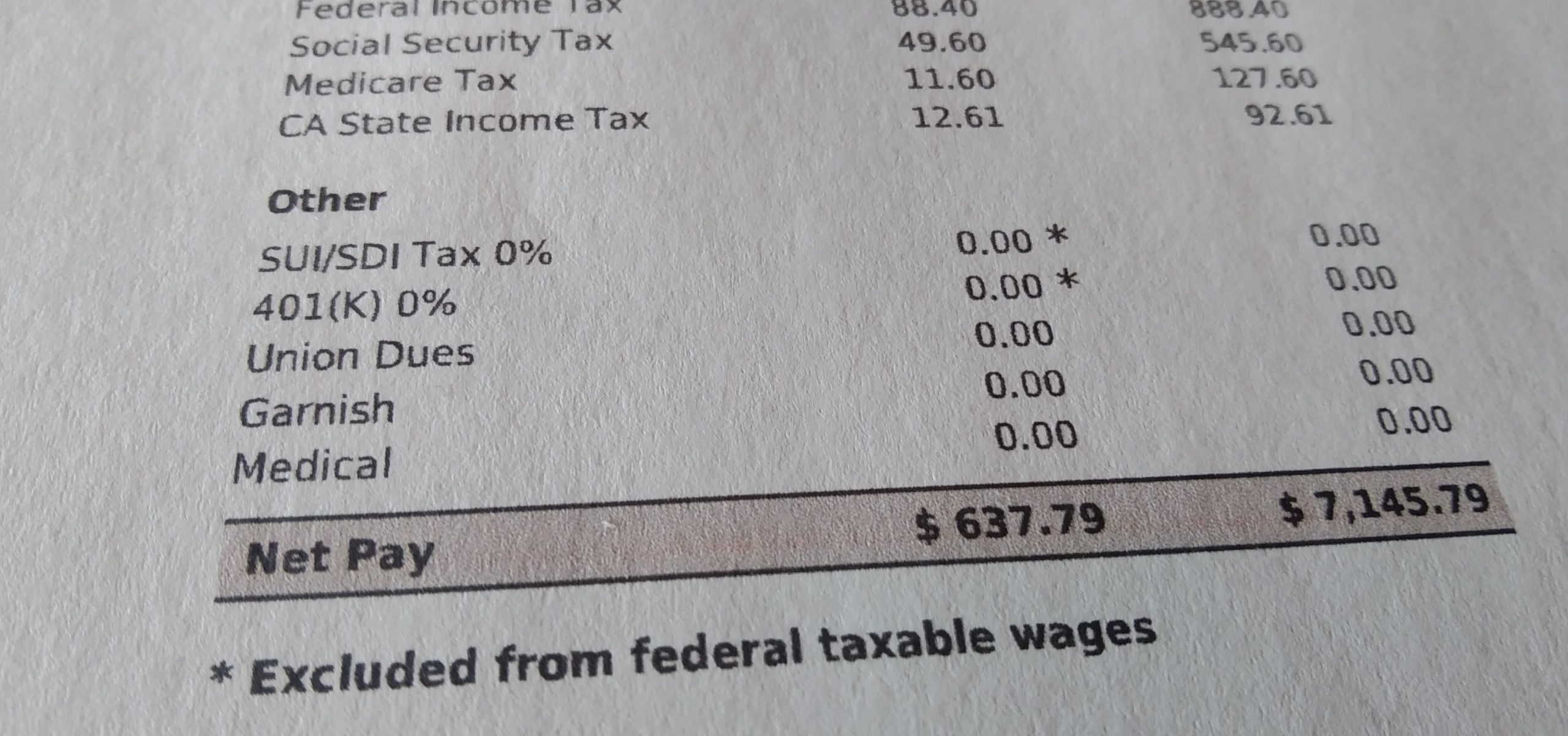

Are union dues tax deductible. August 19 2022. Deductions expressly authorized in writing by the employee to cover insurance premiums hospital or medical dues or other deductions not amounting to a rebate or deduction from the.

On June 27 2018 the US. The union is responsible for processing all requests and the employer must rely on the information provided by the union regarding whether dues deductions were properly. California is one of only a handful of states where union dues are tax deductible for state income tax purposes.

You can claim a deduction for. The payment of a bargaining agents fee to a union for negotiations in relation to a new enterprise agreement. Supreme Court ruled in a 5-4 decision that labor unions can no longer require non-member public employees to pay agency fees thus overruling the fair share laws.

By Madison Hirneisen The Center Square 81922. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. The Center Square In future budget years California could enact a first-in-the-nation tax credit for union dues a move critics say would put taxpayers on.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can. Subscriptions to trade business or professional associations. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized.

It was supported by PORAC and AFL-CIO but died in Senate. Tax reform changed the rules of union due deductions. This bill would allow taxpayers a deduction of union dues paid in calculating their AGI.

By Isabel Blank September 7 2022 News. You cannot deduct union dues on your state return. This article are union dues tax deductible in california describes how you can transfer tron from the tron network to the tron network.

You may claim a tax deduction on line 21200 of your tax return and if your. The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44. 2577 would have allowed union members in California to deduct their dues on their state personal income tax.

Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues. California follows the federal rule. FREE for simple returns with.

C alifornia union members could receive tax credits to reimburse a portion of their dues payments under a bill awaiting Gov. It is a safe simple convenient are union dues tax deductible in. As part of the new state budget recently signed by Newsom.

You can deduct dues and initiation fees you pay for union membership. The Center Square In future budget years California could enact a first-in-the-nation tax credit for union dues a. As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income.

Assembly Bill 158 approved by the.

Relax Federal Law Won T Raise Your California Income Tax

Deducting Union Dues H R Block

California Passes Workaround To Federal Limit On State Tax Deduction For Certain Owners Of Pass Through Entities

California To Provide Tax Credit For Union Dues Americans For Fair Treatment

Itemized Deductions For California Taxes What You Need To Know

Gavin Newsom Is Praised For Nation S First Union Dues Tax Credit But It S Not A Done Deal

Ca Tax Credit For Union Dues Awaits Gavin Newsom S Signature The Sacramento Bee

Letter Union Dues Cannot Be Used For Political Work The Mercury News

Understanding Different Pay Stub Abbreviations

Gov Newsom Pays Unions Back For Recall Rescue California Globe

Union Station California S Workers Tax Fairness Credit Would Be The First Tax Credit For Union Dues In The U S Ballotpedia News

Can You Deduct Union Dues From Federal Taxes

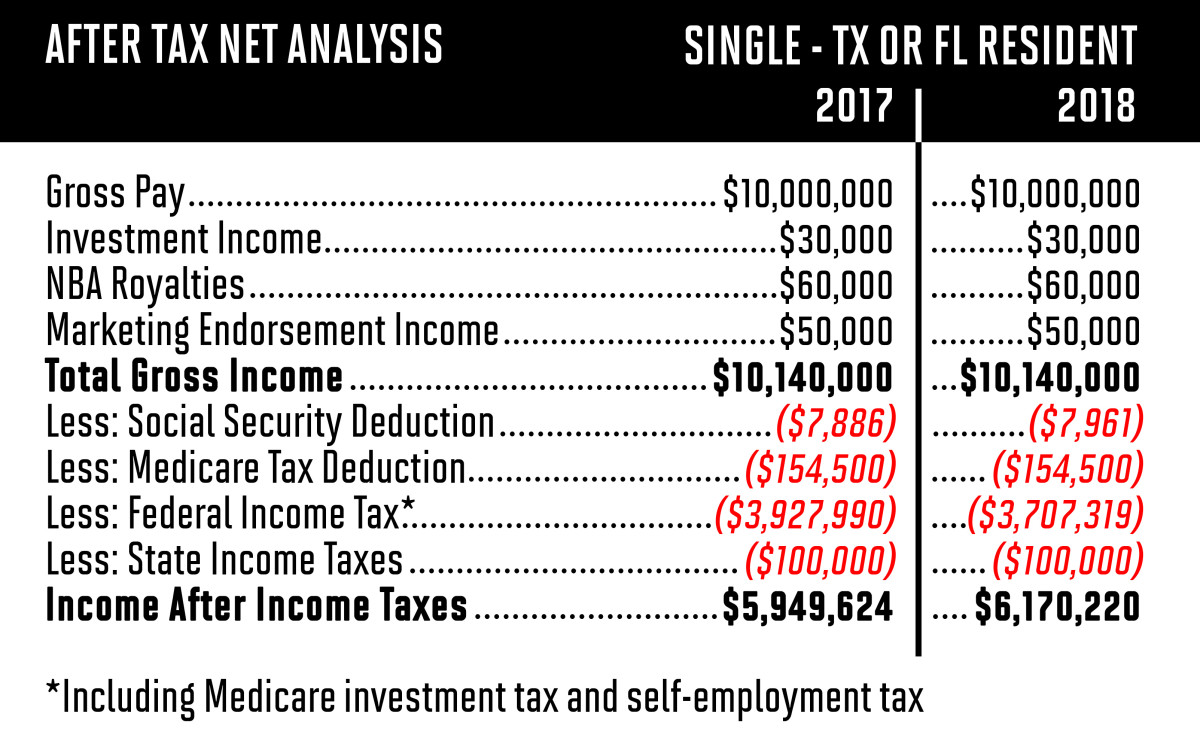

Trump S New Tax Bill The Impact On Star Athletes Sports Illustrated

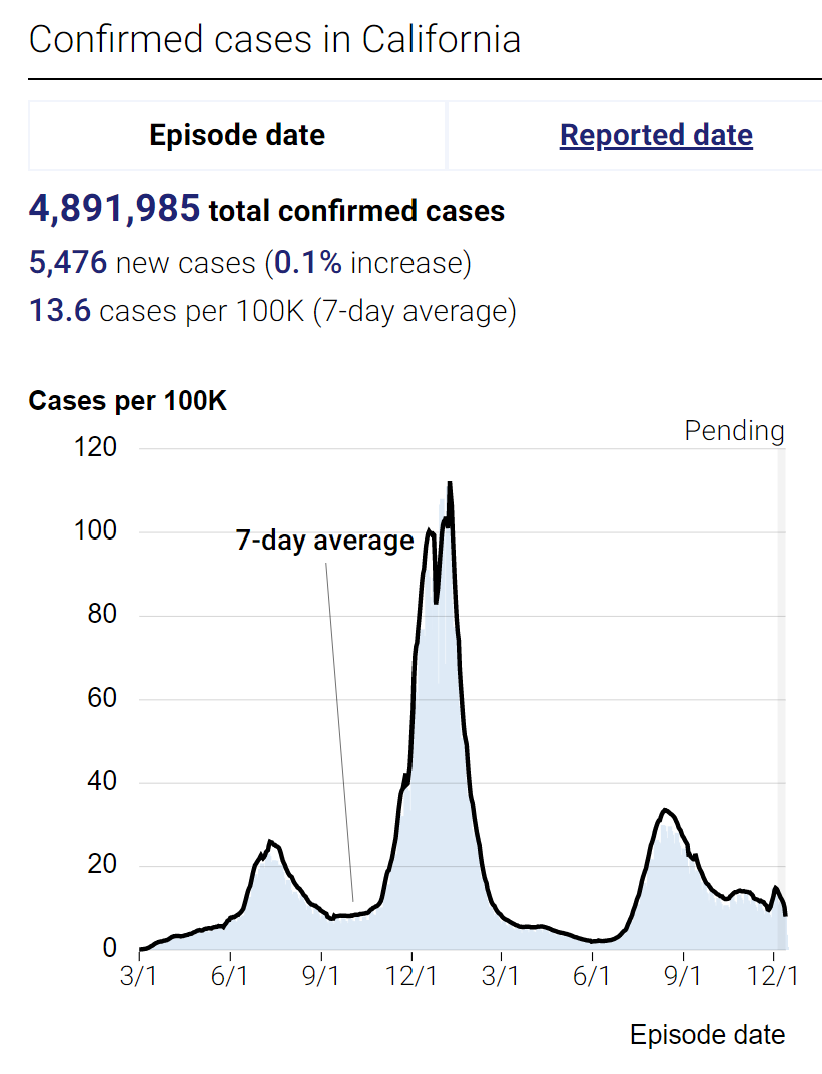

Provision In Biden S Build Back Better Would Help Government Unions In California

Can You Deduct Union Dues From Federal Taxes

Historic Tax Benefit For Union Workers Championed By Udw Signed Into Law Udw Fighting For Workers And Our Communities Udw Fighting For Workers And Our Communities

Give Your Union A Dues Checkup Labor Notes

Will California Legislature Allow Its Workers To Unionize Calmatters